In this comprehensive review, we delve into the intricacies of Mufhiwa Building Society Online or mufhiwa building project , a South African investment platform claiming to generate profits through real estate trading. Our exploration covers various aspects, from the registration process to investment plans, withdrawal procedures, and red flags that demand careful consideration. We'll scrutinize the platform's transparency, evaluate potential earnings, and discuss user experiences, aiming to provide you with a well-rounded understanding of Mufhiwa Building Society Online and assisting you in making informed decisions about your investment choices.

Review of Mufhiwa Building Society Online

Introduction: mufhiwa building project

Mufhiwa Building Society Online, a relatively new player in the South African investment scene, positions itself as a real estate trading platform that leverages trading and real estate management to generate profits. Officially launched on October 31, 2023, the platform operates under the domain mufhiwabuilding-society.online, registered with Namecheap.

How it Works:

Upon registering, users gain access to a user-friendly dashboard featuring sections like Investment, Deposit, Withdraw, and Referrals. The investment process involves depositing a minimum of R200 into the platform, followed by selecting unique investment plans. The return on investment is based on a percentage earnings model, and users patiently await returns.

Features:

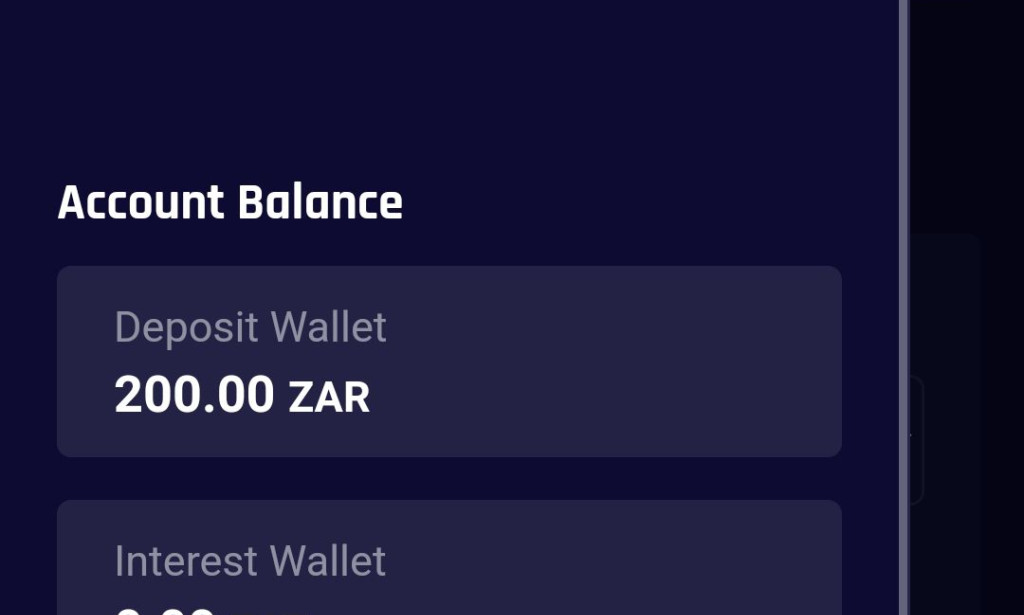

- Wallets: Mufhiwa Building Society Online provides users with two distinct wallets - the Deposit Wallet, currently holding your sign up bonus balance of 200.00 ZAR, and the Interest Wallet, currently registering 0.00 ZAR upon registration.

- Withdrawal: The platform facilitates withdrawals through South African banks, with a minimum withdrawal limit set at R100.

- Deposit: Users can fund their accounts with a minimum deposit of R200, using TRC20 and bank transactions as available methods.

Investment Plans:

Mufhiwa Building Society Online provides users with a straightforward investment structure:

- Primary Plan: Mufhiwa Building Plan

- - Duration: 720 hours

- - Minimum Investment: R200.00

- - Maximum Investment: R20,000.00

- - Daily Return on Investment : 0.50%

- - Total Return (ROI): 360%

Users can choose to invest in this plan, starting from a minimum of R200, and watch their investments grow over the 720-hour period with an assured a daily return of 0.50%, totaling 360%. This structured plan aims to offer stability and profitability for participants looking to engage in real estate-based trading through the platform.

Potential Earnings Calculation:

Investors in Mufhiwa Building Society Online can estimate their potential earnings considering the daily and total returns:

- Investment Plan: Mufhiwa Building Plan

- - Daily Return on Investment (ROI): 0.50%

- - Total Return on Investment (ROI): 360%

- - Duration: 720 hours (equivalent to 30 days)

- - Example Investment Amount: R500.00

Using the formulas:

- 1. Daily Earnings = (Investment × Daily ROI) / 100

- 2. Total Earnings = Investment + (Investment × Total ROI) / 100

For a daily return with R500 investment:

Daily Earnings = (R500 × 0.50) / 100 = R2.50

For the total return over the 30-day period:

Total Earnings = R500 + (R500 × 360) / 100 = R2,300.00

Investors can potentially earn R2.50 daily and a total of R2,300.00 over the 30-day duration with a R500 investment in the Mufhiwa Building Plan. These calculations provide insights for users assessing their potential returns within the specified investment framework.

Referral Program:

Mufhiwa Building Society Online encourages user engagement through a referral program where participants earn commissions from referrals. An interesting incentive mentioned by a Facebook user suggests a R200 welcome bonus and the potential to make a daily return of R24, with a minimum withdrawal threshold set at R100.

Domain Information:

The domain mufhiwabuilding-society.online is registered until October 31, 2024, through Namecheap. The status is clientTransferProhibited, indicating certain restrictions, and the platform relies on the name servers ns1.dns-parking.com and ns2.dns-parking.com.

Is it Legit or a Scam? My Perspective:

Addressing the crucial question of legitimacy, drawing from my experience with South African investment platforms, there's a sense of déjà vu. Reminiscing about past platforms like Bamboo Globalization, which initially seemed promising but ultimately crashed, leaves me cautious.

This new entrant, Mufhiwa Building Society Online, raises red flags. The lack of transparency regarding its income source triggers concerns. Claims of users earning up to R2300 in less than 30 days seem ambitious and beg the question – where is this additional money magically appearing from?

Digging deeper, it appears to follow the ominous pattern of a Ponzi scheme. Relying on newer investors to compensate earlier ones often leads to a house of cards scenario. The phrase "invest what you can afford to lose" echoes in my mind, a stark reminder of the potential risks.

Adding to the skepticism, the absence of payment proofs is a significant drawback. In the absence of tangible evidence, doubts about the platform's credibility intensify.

Based on these observations, Mufhiwa Building Society Online seems more aligned with the characteristics of a scam rather than a legitimate investment opportunity. Caution and thorough scrutiny are advised before considering any involvement with this platform. Peace.

Customer Service:

Mufhiwa Building Society Online offers multiple avenues for customer support:

- Contact Info:

- Phone: +27 60 868 4451

- Email: support@mufhiwabuilding-society.online

- Office Address: 23 Bakwena Building, Rustenburg, North West, South Africa

- Support Ticket:

- Users can submit support tickets for prompt assistance, providing an organized way to address concerns or seek clarification.

Registration Guide:

To register with Mufhiwa Building Society Online and embark on your investment journey, follow these steps:

- 1. Visit the registration page at https://mufhiwabuilding-society.online/user/register.

- 2. Fill in the required details:

- - Username

- - Email Address

- - Country

- - Mobile Number

- - Password

- - Confirm Password

- 3. Confirm your agreement with the Privacy Policy and Terms of Service.

- 4. Click "Register" to complete the registration process.

Login Guide:

For returning users, accessing your account is a straightforward process:

- 1. Visit the login page at https://mufhiwabuilding-society.online/user/login.

- 2. Provide your Username or Email and Password.

- 3. Optionally, select "Remember me" for quicker future logins.

- 4. Click "Login" to access your account.

Forgot Your Password?

If you forget your password, follow these tips to recover it:

- 1. On the login page, click on "Forgot Your Password?"

- 2. Enter the email associated with your account.

- 3. Check your email for a password reset link.

- 4. Click the link to reset your password securely.

- 5. Create a new password following the specified requirements.

- 6. Return to the login page and access your account with the updated password.

By following these straightforward steps, users can seamlessly register, login, and manage their accounts on the Mufhiwa Building Society Online platform.

Red Flags: Unveiling Concerns

As I scrutinize Mufhiwa Building Society Online, additional red flags emerge, heightening the need for caution among potential investors:

1. Unknown Source of Income: The platform's lack of transparency regarding its income source raises significant concerns, casting doubt on the legitimacy of its operations.

2. Ambitious Return Claims: Promises of users earning up to R2300 in less than 30 days sound overly optimistic and may signify an unsustainable or deceptive investment model.

3. Ponzi Scheme Dynamics: The reliance on new investors to fulfill returns for earlier participants echoes the characteristics of a Ponzi scheme or pyramid scheme, which historically leads to financial instability and collapse.

4. Cautious South African Investment History: Reflecting on past experiences, such as the downfall of Bamboo Globalization, adds a layer of skepticism about the platform's reliability and sustainability.

5. Cryptic Operations: Mufhiwa Building Society Online operates with an air of mystery, lacking transparency about its team and providing no payment proofs. Transparent and trustworthy platforms typically disclose vital information about their operations.

6. No Mobile APK Download: The absence of a dedicated mobile APK or app for download raises concerns about the platform's commitment to accessibility and user experience. Reputable investment platforms often provide user-friendly mobile applications.

7. Lack of Payment Proofs: The absence of tangible evidence, such as payment proofs, further erodes confidence in the platform's legitimacy. Trustworthy investments usually showcase transparent proof of successful transactions.

8. Risk Warning Echo: The common advice to "invest what you can afford to lose" resonates as a warning, signaling potential risks associated with engaging in this platform.

Considering these collective red flags, potential investors are strongly urged to exercise extreme caution. Thorough research, due diligence, and critical evaluation of these warning signs are essential before considering any involvement with Mufhiwa Building Society Online.

Conclusion:

While Mufhiwa Building Society Online presents an intriguing opportunity for real estate-based investments, potential investors should approach with caution. Concerns surrounding anonymous leadership, undisclosed income sources, and the absence of a mobile app raise red flags. Thorough due diligence and consideration of these factors are advised before engaging with the platform.

You must be logged in to post a comment.