This has led to gold and silver prices touching all-time highs this October 2025, with the metal combining to become hotly debated among investors, as to whether this rally has more fuel or a correction is imminent. Gold futures on MCX have moved above ₹ 80,000 per 10 grams, while silver has surged past ₹ 1,05,000 per kilogram-both all-time high driven by global and domestic market dynamics.

Why so high a price for gold and silver?

The continued rally in precious metals became larger due to growing rate cut expectations of major central banks, festering concerns over inflation, and geopolitical tensions that would not die down. Investors increasingly used the haven of gold and silver as a hedge against market uncertainty.

In fact, central banks, especially those in Asia and the Middle East, have been one of the aggressive buyers of gold in 2025-a testimony to long-term price strength. A depreciating Indian rupee, along with the festive season demand ahead of Dhanteras and Diwali, has given an extra fillip to local prices.

Global and Domestic Factors Favoring the Rally

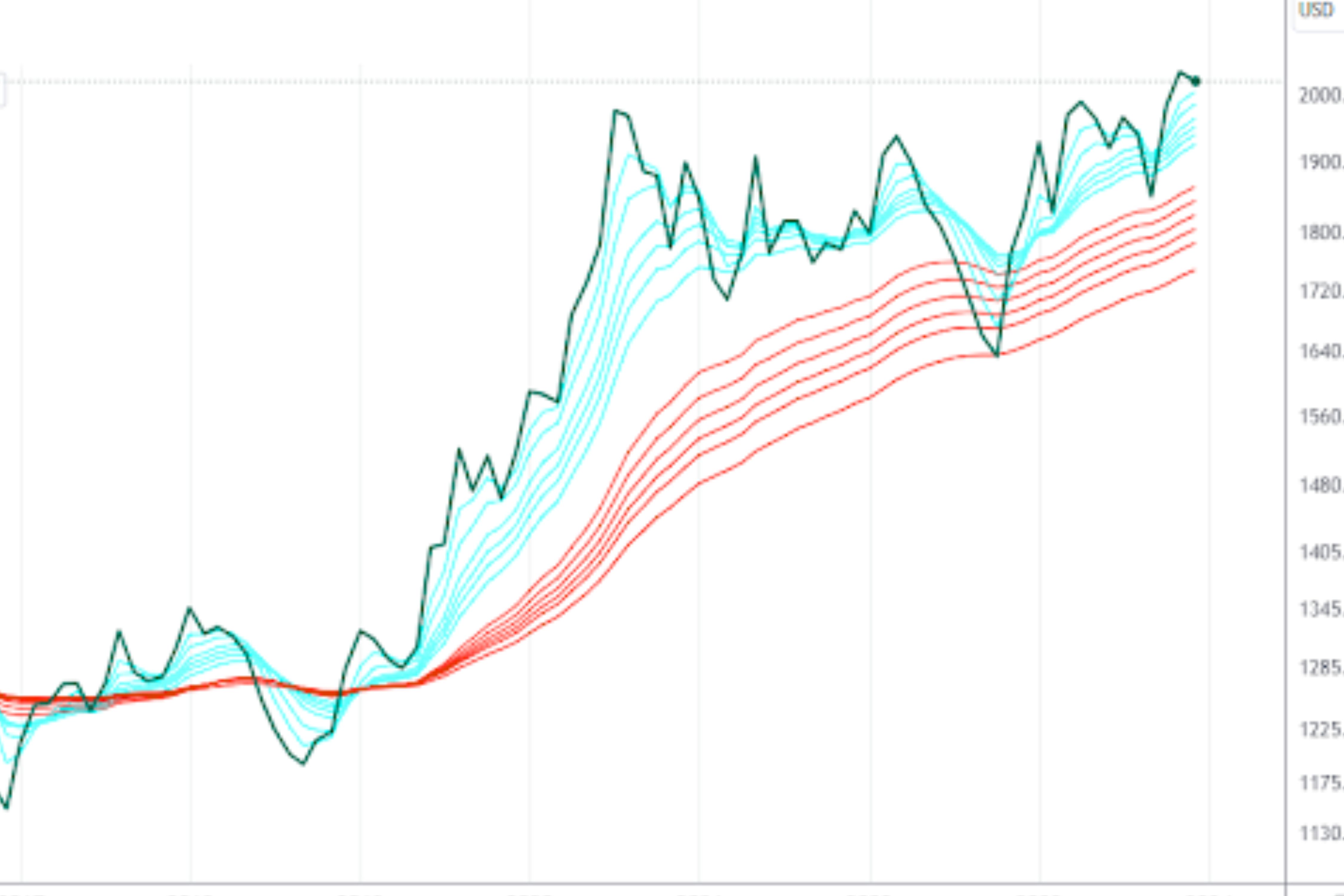

Internationally, the firming of gold at US$2,700/oz and silver prices trading at near US$33/oz level are over a decade highs. Many link the outperformance of silver to rising industrial demand from electric vehicles manufacturing and making of solar panels.

Whereas domestic consumption is stable, and the rupee is deprecating against the US dollar have magnified the rally on MCX. Domestic gold prices may take support near ₹ 78,000 and may test ₹ 82,000 if the momentum continues as per a belief by commodity experts.

Will the Rally Last?

Market analysts, however, remained divided in their view. Whereas a section believes that after such steep gain, prices would consolidate, others feel that the structural bull market in precious metals would continue into 2026. Upcoming central bank policy decisions, inflation data, and currency movement would now determine whether the rally would sustain or see some short-term profit booking.

Investor's View

Meanwhile, inept opinion advises investors not to chase a price at record highs, but to practice staggered buying. Gold stays robust as a hedge against inflation and market volatility, while strong growth for silver is driven by both industrial and green energy demand.

Im ready

You must be logged in to post a comment.